Fairfield Car Repair Lawyer

Fairfield Car Repair Attorney

When it comes to car repairs in Fairfield, you can use either your own insurance or the other driver’s insurance.

This article helps you decide the best course of action. Although it’s never a bad idea to contact a Fairfield car accident lawyer.

The choice depends on your deductible, which is the amount you must pay before your insurance kicks in. Your insurance policy covers your property damage, regardless of fault, but you’ll need to pay your deductible first, typically around $500. Afterwards, your insurance company will seek reimbursement from the at-fault driver’s

insurance, a process that can take from two weeks to six months.

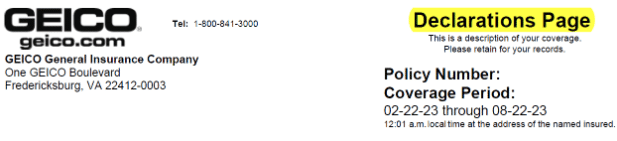

Important Note: To access your insurance coverage details, log in to your car insurance company’s online portal and locate the “policy documents” section. Look specifically for the “declarations page,” which provides a summary of your coverages. This page will be labeled with a header resembling the below:

Car Repairs and Property Damage Recovery in Fairfield

In contrast, the other driver’s insurance will pay the property damage and car repairs without charging you a deductible. If that’s true, then you may be wondering why you wouldn’t always go through the other driver’s insurance. It comes down to how quickly you need the car repaired. Typically, your company will pay for the repairs quicker than the other driver’s. This is because your company has a contract with you, and they are legally obligated to pay for the repairs.

The other driver’s insurance company doesn’t have a contract with you. They can jerk you around, deny their driver was at fault, and take a long time to pay the repairs. You will need to ask yourself, “How quickly do I need my car back? Can I afford to shell out $500 for the deductible right now?”

Finally, your Fairfield insurance policy will typically have a clause that gives you the right to choose which mechanic to use for the car repairs. Make sure to check your policy’s language under the “collision coverage” section to see if you have that right. The other driver’s insurance company doesn’t have to give you that choice. They might mandate that you go to one of their preferred Fairfield mechanics instead of one of your choosing.

Important: If you go through the other driver’s insurance company to pay for your car repairs, do not sign any release of liability. It’s possible the other insurance company may try to trick you into releasing (forever giving up) your personal injury claim. If you are worried about waiving any of your legal rights, contact an experienced Fairfield personal injury lawyer today.

Here are the pros and cons to help you weigh the options of using your insurance or the other driver’s:

Which Insurance to Use

Your Insurance

Pros:

- Repairs will be paid for more quickly.

- You are usually able to choose the mechanic.

Cons:

- You will need to pay the deductible.

- It could take weeks or months to be reimbursed for the deductible

Their Insurance

Pros:

- You don’t pay any deductible

Cons:

- They can take longer to pay for the repairs.

- You might not get to choose the mechanic.

From a practical standpoint, you should call both insurance companies and talk to the claims representative assigned to your file. Explain the situation and who was at fault. During those calls, you’ll be able to see who is more responsive and cooperative.

If the other driver’s insurance representative admits fault and agrees to pay for the repairs, that’s a good indication you should go with their insurance. But make sure you have them send you that promise in writing. If their insurance denies fault or is unresponsive, you may want to think about using your insurance first, paying the deductible, and seeking reimbursement later.

Beware of the “Preferred” Auto Body Shops in Fairfield

If you want a reliable car repair, you should insist on using a Fairfield mechanic you know and trust. Insurance companies have special relationships with certain body shops in any given geographic area, which they use as their own “preferred” body shops. These shops work with the insurance companies under a sort of back-scratching arrangement, where the insurance company will send damaged vehicles that need repairs to that shop above other shops.

The reason this is an issue is that if your car is sent to a preferred body shop, the insurance company can have a great deal of say in how the car is repaired. They can force the shop to use after-market parts or used parts. The preferred shops artificially decrease their labor rates for their insurance company masters. These arrangements are good for the preferred shop to receive guaranteed income from the insurance company, but they aren’t good for you or your car.

Yes, the overall cost of repairs at a preferred shop will likely be lower, but that’s savings only for the insurance company. In short, you should find reputable garages in your area that do quality work and aren’t preferred providers for insurance companies.

Totaled / Badly Damaged Cars

If your car was towed, remember that the auto body shop will charge you to store your vehicle. There may be hefty storage fees ($200 / day) that add up quickly. As a result, you should act QUICKLY to either get your car repaired and released FAST or simply get it totaled. Otherwise, you might be on the hook for a huge storage fee. If the car is totaled, take the money, pay your car note, and look for another car. It’s best to move on.

If your car is totaled, any Fairfield insurance company (yours or theirs) is only responsible to pay you for the fair market value of what your car was worth at the minute the accident happened. They don’t pay sticker price, and they don’t pay your car note. Go to Kelly Blue Books or another similar resource to see what your car is worth with depreciation.

If you owe more on your car loan than what the totaled value is, check to see if you have “Gap Coverage.” That coverage pays for the difference between what is left on your auto loan and the totaled value. If you didn’t buy gap coverage, you might still be on the hook for the leftover loan balance.

Choose a Partner You Can Trust

After a car accident, it can be frustrating to arrange car repair services while waiting for compensation for the accident. Allow Brill Law Group to take the stress out of it.

Our team can help you file your claim, secure compensation, and get your car back in working condition in no time.